Designer Fund Guide to Building a Winning VC Pitch Deck

If you’re looking to land VC funding for your company, one of the smartest investments you can make is to build a stellar pitch deck. A pitch deck is the hook that gets investors interested in your company’s potential—it helps articulate your vision and progress and, when done well, can play a huge part of helping you raise capital.

While there are a lot of great resources that share high level guidance and examples of winning pitch decks, we wanted to share what we think truly makes a great deck—and where and why founders go wrong. Over the course of our nearly 10+ year careers, my Designer Fund co-founder Enrique Allen and I have looked at thousands of pitch decks—some good, some bad, and everything in between.

As designers, we know how to communicate effectively and tell good stories—and unfortunately, this is where most pitch decks we see fall short.

In this comprehensive guide, we’ll share the core principles of crafting a compelling fundraising deck. Drawing from our own expertise and insights from top investors like Bloomberg Beta’s Roy Bahat and NFX’s James Currier, we'll cover everything from highlighting your core strengths to structuring your slides for maximum impact and clarity. Read on—and make sure to check out our Pitch Deck Resource Library for even more recommended resources on the subject.

Key points for designing a great pitch deck

More than anything, a pitch deck is a story. It needs to be cohesive and compelling, and convince VCs that your company is an inevitable success. But before you open up Figma or Pitch.com to start building a deck, here’s what you need to write your story.

The goal of a pitch is to turn VCs into believers. If you get only one thing right, nail the narrative.Tommy Leep, Founding Partner, Jetstream

1. The number one question: Will your company allow your investors to 50x-100x their money?

At the most basic level, seed investors need to know that investing in your company will help them make money—because that’s their job. There’s no sugarcoating it—the math behind a fund requires picking companies that won’t just return their investments a few times over, but actually return their investment 50x-100x.

What does this translate to? At the most fundamental level, you need to convince investors you are ready to build a big, big company—make this central to your pitch deck story.

An investor’s key job is to return capital many times over. Everything in your pitch deck should ultimately prove this argument: Invest in us and we’ll help you make a lot of money. Do not lose sight of that fact.Ben Blumenrose, Co-Founder of Designer Fund

The confidence to make it happen

In my experience, the best founders tend to speak almost as if their vision for the future is inevitable. They’re excited by the road ahead. They’re excited by how hard it’s going to be. They’re excited by the scale of that work. And they have no doubt they will achieve it.

I think back to Mark Zuckerberg when I first worked at Facebook. He was completely confident in his vision of getting every person in the world on Facebook. When I told him years ago, “Mark, billions of people in the world don’t even have internet access,” he responded, “Well, we’ll bring them online.” That’s the kind of confidence and inevitability you want to have when pitching VCs.

💡 Insight: Not every company needs to be VC-funded

If your company doesn’t have a clear case for investors getting 50x-100x on their investment, you might need to revisit your business concept—or consider alternative funding. I’ve seen some great concepts over the years that will likely turn into great companies, but they’re not good candidates for venture funding. Consider what sort of funding structure makes the most sense for your company.

2. Tailor your story to the investor and stage

Know know who you’re pitching to and what they value. Every investor looks at the world differently and will prioritize different areas of an investment opportunity. Some investors will be much more team-oriented, others very market- or business model–oriented, while some like Designer Fund will have more of a product orientation.

Next, don’t be afraid to highlight or emphasize different parts of your story depending on who you’re talking to. For example when teams pitch Designer Fund, founders will often highlight their relationship to design, how important they realize it is to the success of the business, and how much they want to ensure a high level of design in their product. Since they know we invest in founders that value design, doing this is probably a good idea. 🙂

Similarly, in The 23 Rules of Storytelling For Fundraising, James Currier, General Partner at NFX, explains:

Each time you start to tell your story again, you’ve got to be able to judge the room and speak to what they’re interested in, only including only the key details that are relevant for that audience. You need to adjust your story so that they can understand from their perspective—using their language—what you are doing and why it’s interesting for them.James Currier, General Partner, NFX

Additionally, don’t forgot to tailor your messaging to make sense with your company’s stage. If you’re a pre-seed company with a 30-page deck and a data room, you’re probably doing it wrong. Conversely, if you’re a seed company and your full pitch/memo lacks details about your team, the market opportunity, the product, or other key areas, you’re unlikely to escape an investor meeting unscathed—assuming you get one in the first place.

💡 Insight: Mission-oriented founder? You need to speak two languages when pitching investors

Enrique and I encountered this challenge when we were first pitching our concept for Designer Fund. Although we developed Designer Fund with a strong mission of building a design community that could facilitate bringing better designed products and services into the world, when we only used that language with investors, they couldn’t care less. Our pitches fell flat because mission alone wasn’t enough.

While as an investor I still want to know if you’re a mission-oriented founder (it means I know you’ll walk through hell and back to make this idea happen), I ultimately need to know that your business is going to 50x-100x my investment (see question number one above). You need to speak both languages through your pitch deck. So, find a way to tell that story: How will achieving the mission of your company help your investors achieve their mission of returning capital many times over?

3. Center your story around 2-3 core strengths

This is the core of your story. Ask yourself: What are the three most convincing pieces of your pitch? Is it your team, market, traction, product, fundamental IP or something else? Find those two to three things and really nail them. Once you’ve identified these strengths, distill the crux of your pitch into two to three sentences and build your narrative around that. Here are some examples:

- Netlify: Website-building platform Netlify had both team and traction. Their core pitch deck narrative? “The way we’re building websites today is slow and insecure, costing companies billions of dollars. We have the domain expertise to build a new type of web infrastructure and early traction shows our approach is working.”

- Monograph: Architecture project management software company Monograph focused on their team and the product. Their core narrative: “Billions of dollars are paid to architecture firms every year but they struggle to know if their projects are on time and on budget. We are a team of designers, engineers, and architects who viscerally know this problem and have built a product that will solve this for architecture firms.”

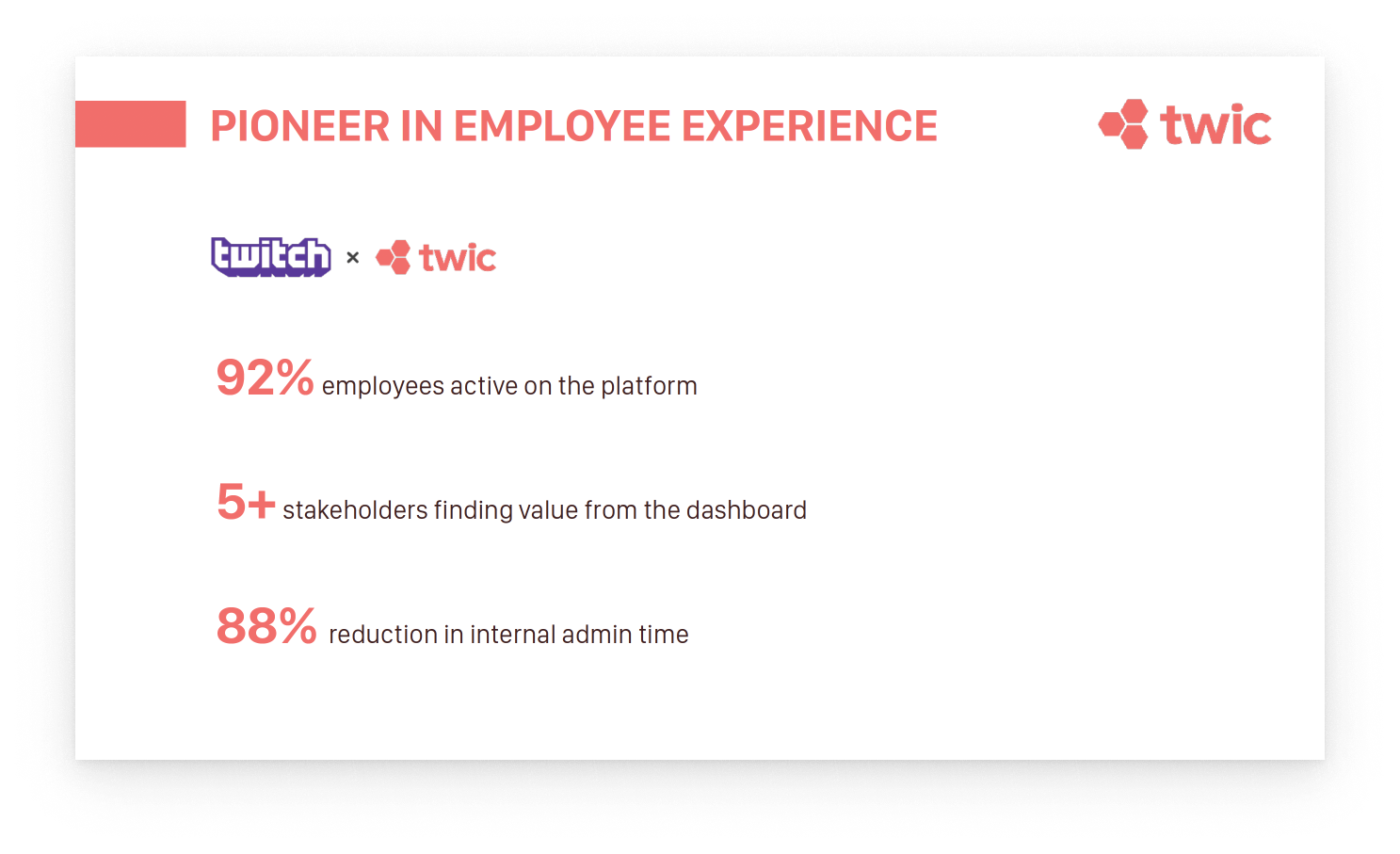

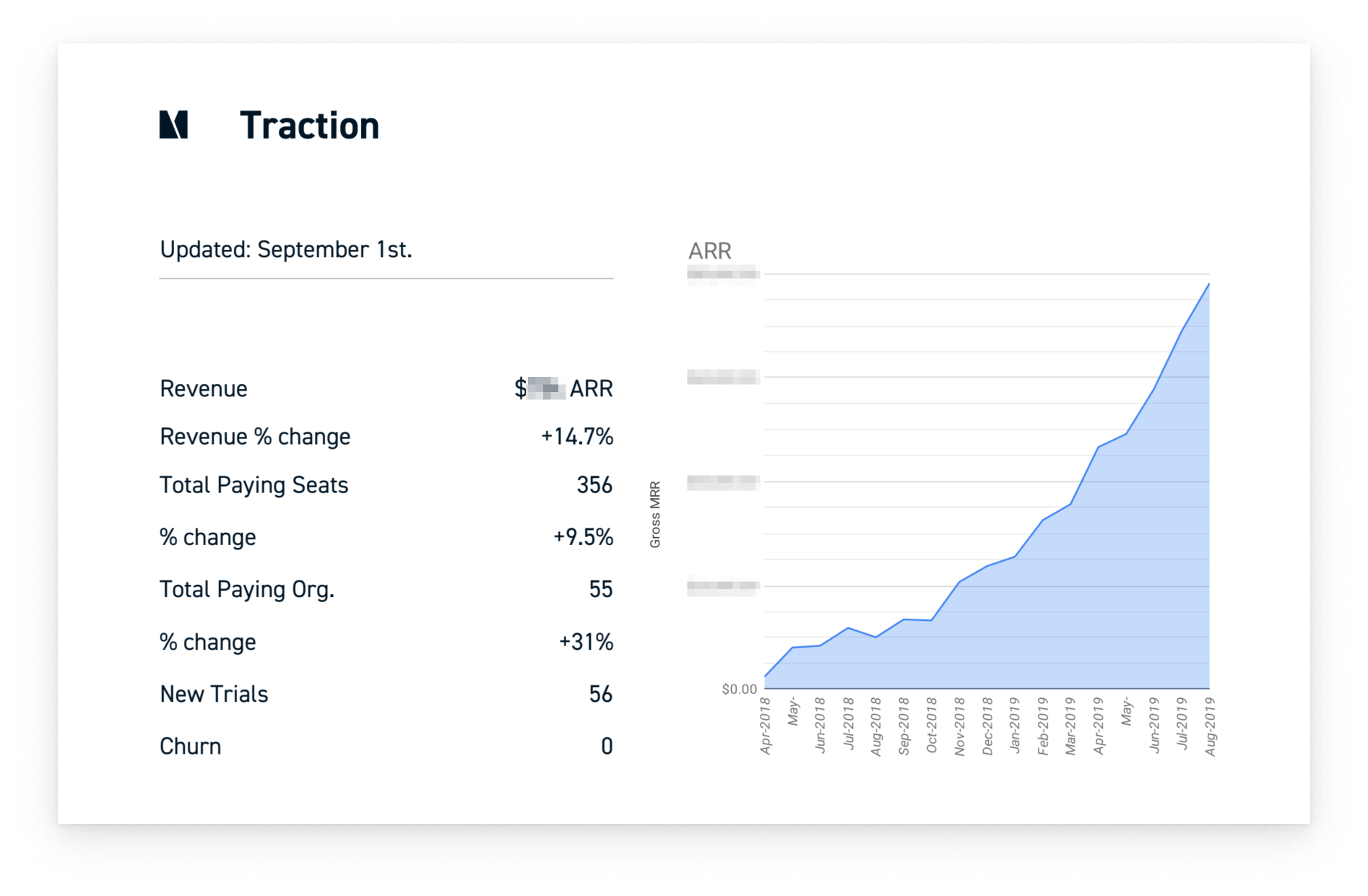

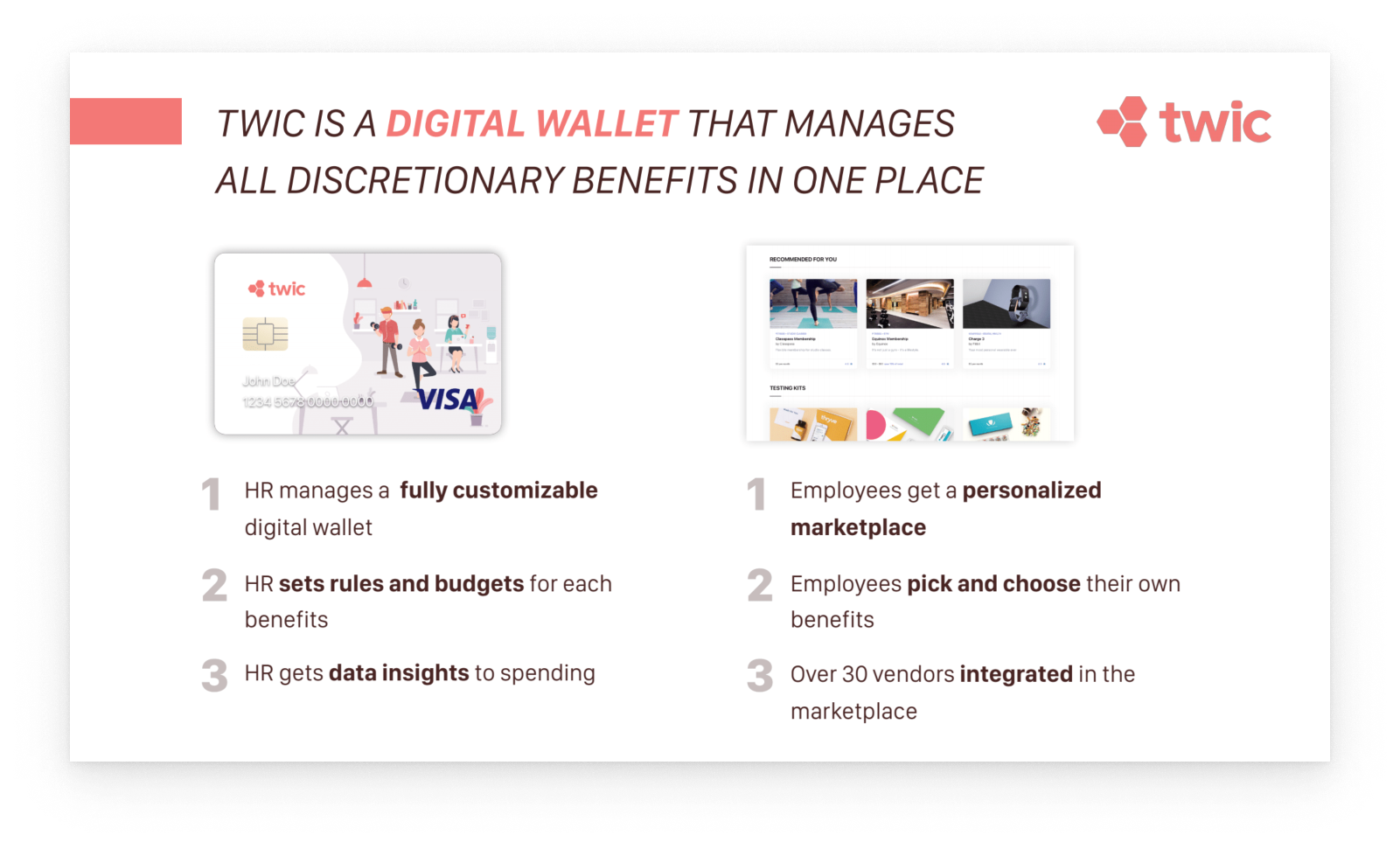

- Forma: Forma, a decentralized employee benefits platform formerly known as Twic, had both product and traction that made us sit up in our seats. Not only had they built a product, they’d sold it to two large companies and had fully deployed at those companies, and it was actually USED by many of the employees already. When you have that, you shout it from the rooftops.

This is Forma (formerly Twic)'s original “traction slide” that made us take notice:

By their series A, the traction slide looked like this, validating how they were clearly solving a painful problem in the right way for multiple companies:

Want to see more examples of real pitch decks from successful companies? Check out our Pitch Deck Resource Library for a collection of hand-picked examples and templates.

Show why you have the winning team—or focus on your other strengths until you do

If having a great founding team is one of your core strengths, make sure to highlight that as part of your narrative. This is not the time to be shy! Ideally investors want to know: that you’re exceptional leaders; that you’re uniquely suited to solve this problem; and that you’ve been able to convince other great people to be part of your journey.

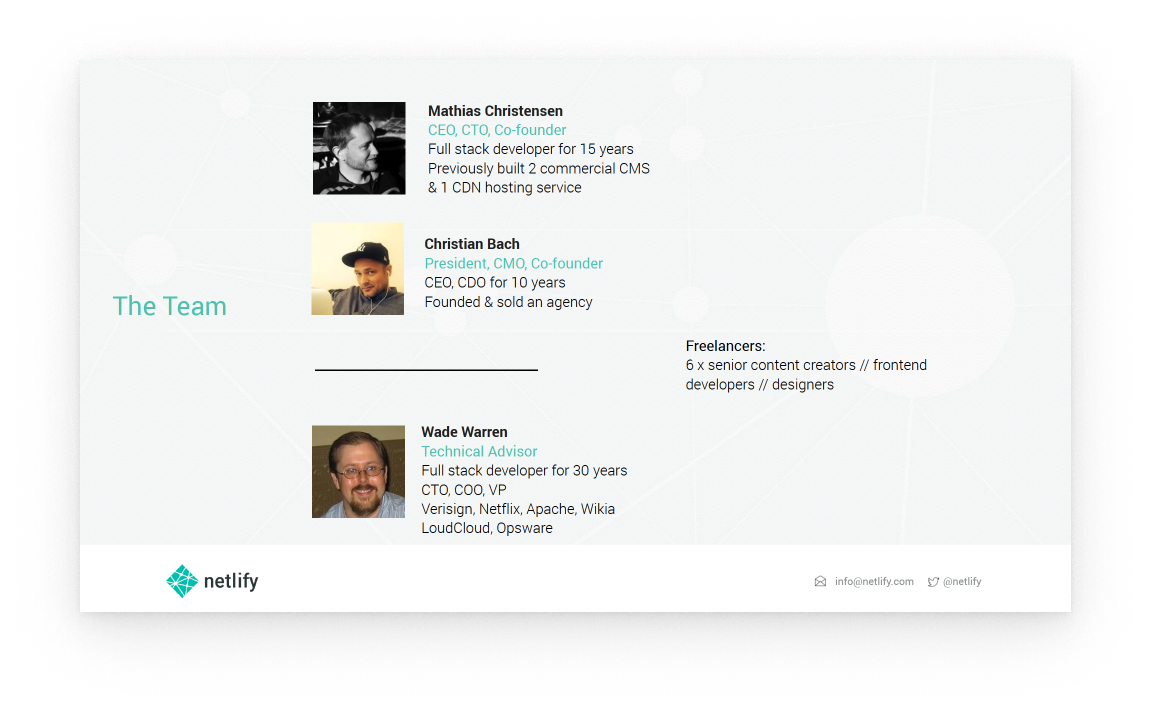

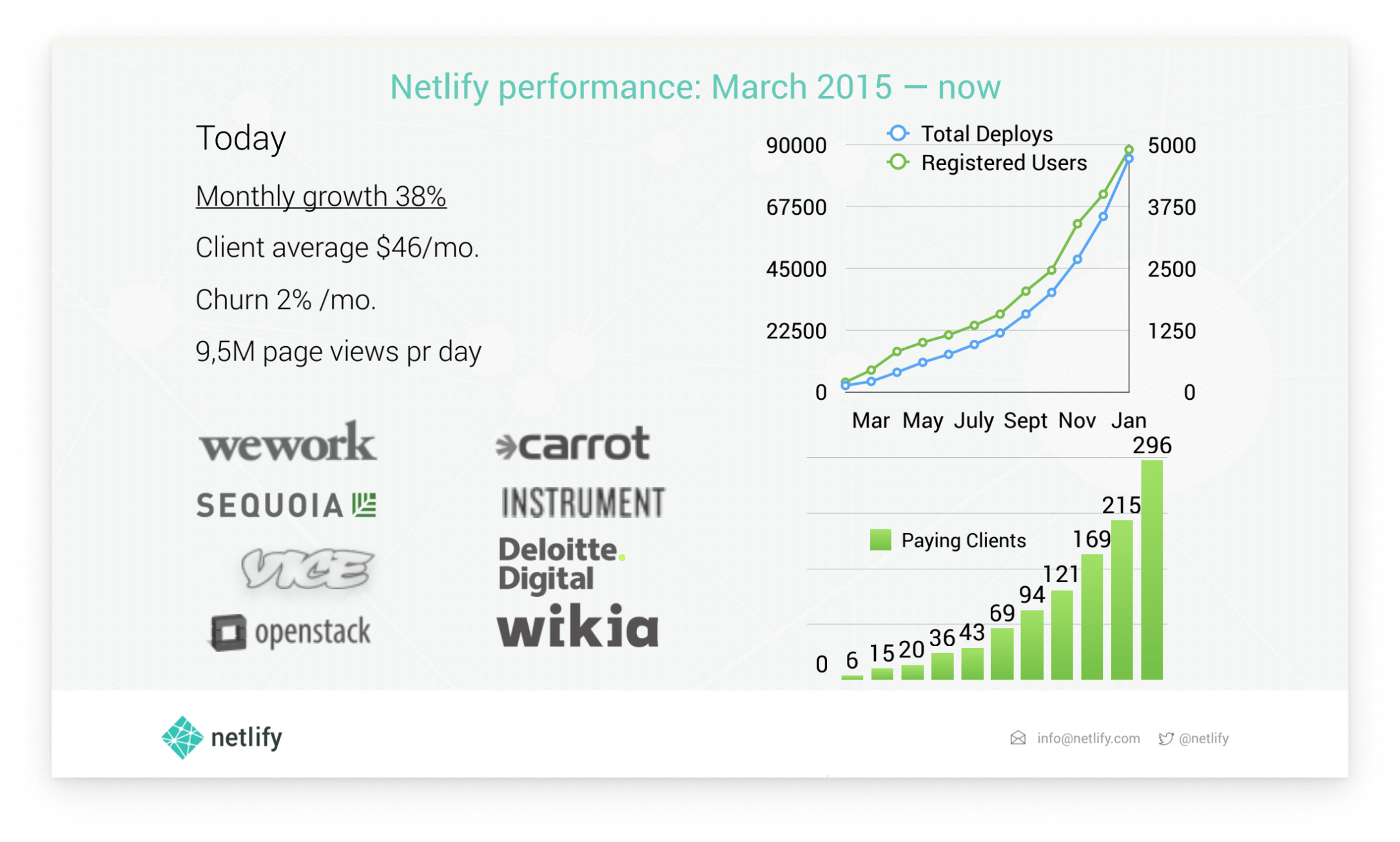

If you don’t have an obvious winning team right out of the gate, focus on your other strengths. For example, at seed, the Netlify team didn’t have many of the “logos” investors often use for signals—top schools, top startups, or top investors.

What they did have was a technical team with deep domain expertise and great early traction: nearly 300 paying customers and 5,000 users helped get investors over the line.

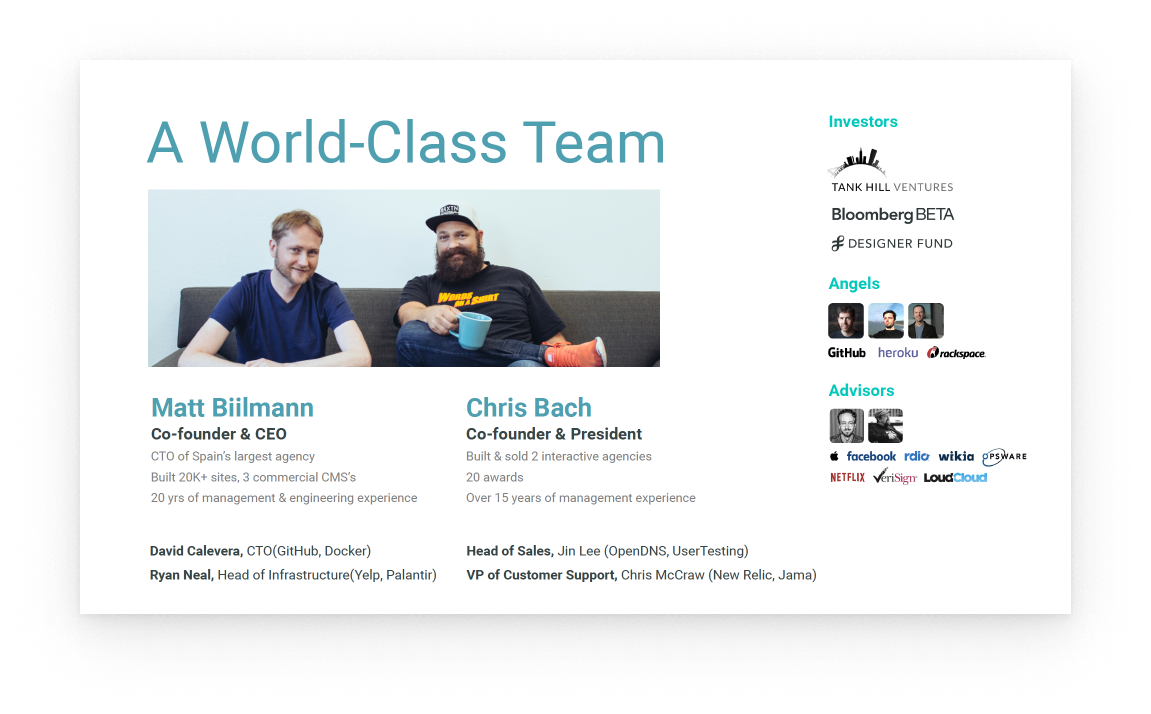

By their series A you can see a number of great investors, angels, and advisors had signed on, and Netlify’s updated pitch deck did a great job of highlighting those relationships. If you are raising your seed round, make sure you highlight any great affiliation past or present, domain expertise, or exceptional accomplishments.

Another example—Framer, formerly known as Motif—had one of the most humble team slides we’d ever seen, which very much fit their personality! Founders Koen Bok and Jorn van Dijk are two of the best designers/product builders we know: they sold their company to Facebook, they built great software there used by hundreds of millions of people, and they’d won Apple design awards, just to name a few highlights. All these accomplishments are listed almost like whispers at the bottom of the team slide. If we had to redo their team slide today we’d flip the bottom bullets into the main headline.

💡 Insight: Are you a silicon valley “outsider”? Make it part of your story

Venture capital has a diversity problem. The field is still overwhelmingly white, male, based in Silicon Valley, and Ivy-educated. If you don’t fit into this specific set of characteristics, it can be harder to access funding. To combat this, you need to find a way to make that difference a part of your pitch. What about your background makes you uniquely suited to solve the specific problem your product is focused on?

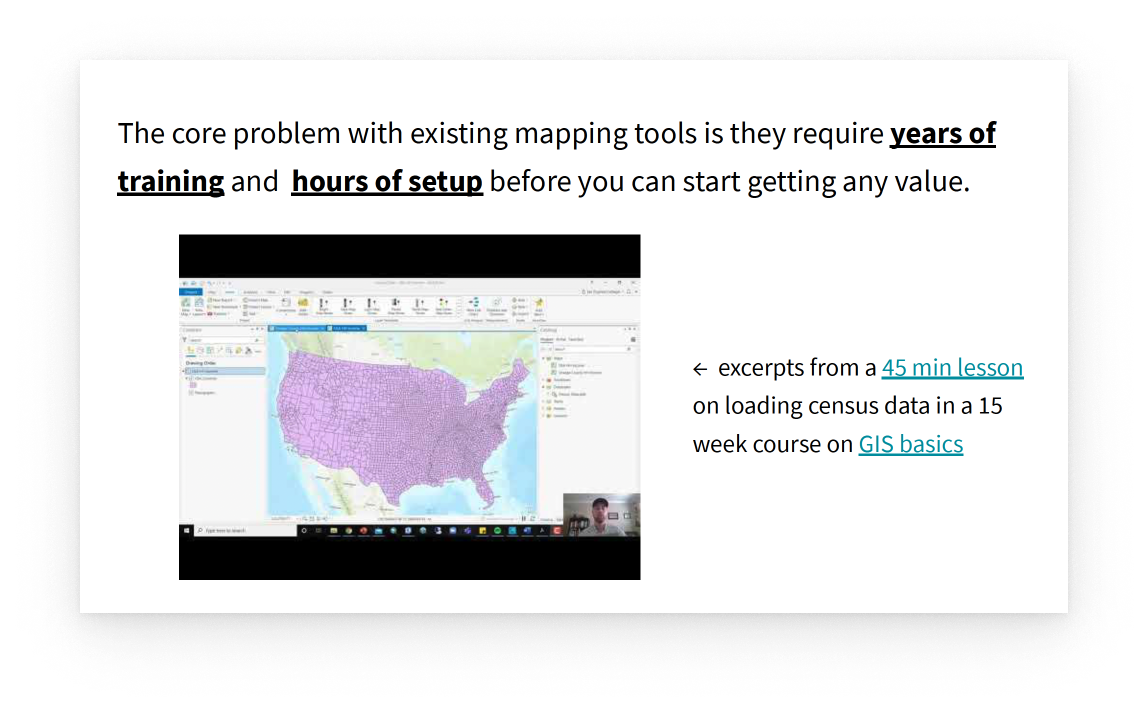

4. Explain why the problem you’re solving is a hair-on-fire problem

Ideally, your pitch deck should show the problem you’re addressing costs companies or people a lot of time or money. The problem needs to feel urgent and big—and your solution needs to feel absolutely necessary. If what you’re offering seems like a vitamin versus a true painkiller, you’ll have a tough time selling the product and growing fast as a company.

Find ways to make your problem feel really tangible to investors—a true hair-on-fire problem. Invite them to grow their empathy by stepping into the shoes of a customer, or share details and other data that make the pain point feel undeniable.

5. Focus on just one idea per slide

Use headlines to keep each slide focused on one thing at a time—which will help you create a more memorable narrative. It should be very clear when you look at a slide what the core idea of that slide is. If that’s not evident in three seconds, you’re not putting the right information upfront.

Keep it simple:

- “Our revenue is growing 5x”

- “Our team is uniquely suited to solve this problem”

- “Our product is loved by hundreds of people”

If you find that you present a slide by reading the content on each slide, you’ve put too much content on each slide.

One way to help solve this? Use slide headlines to focus on key takeaways. Make each slide’s headline the one point you want the investor to understand from that slide. For example, this performance slide was a big reason we invested in Netlify. The headline is “Netlify Performance” but really the key point is “We grew from 0 to 300 paying clients in ONE YEAR.”

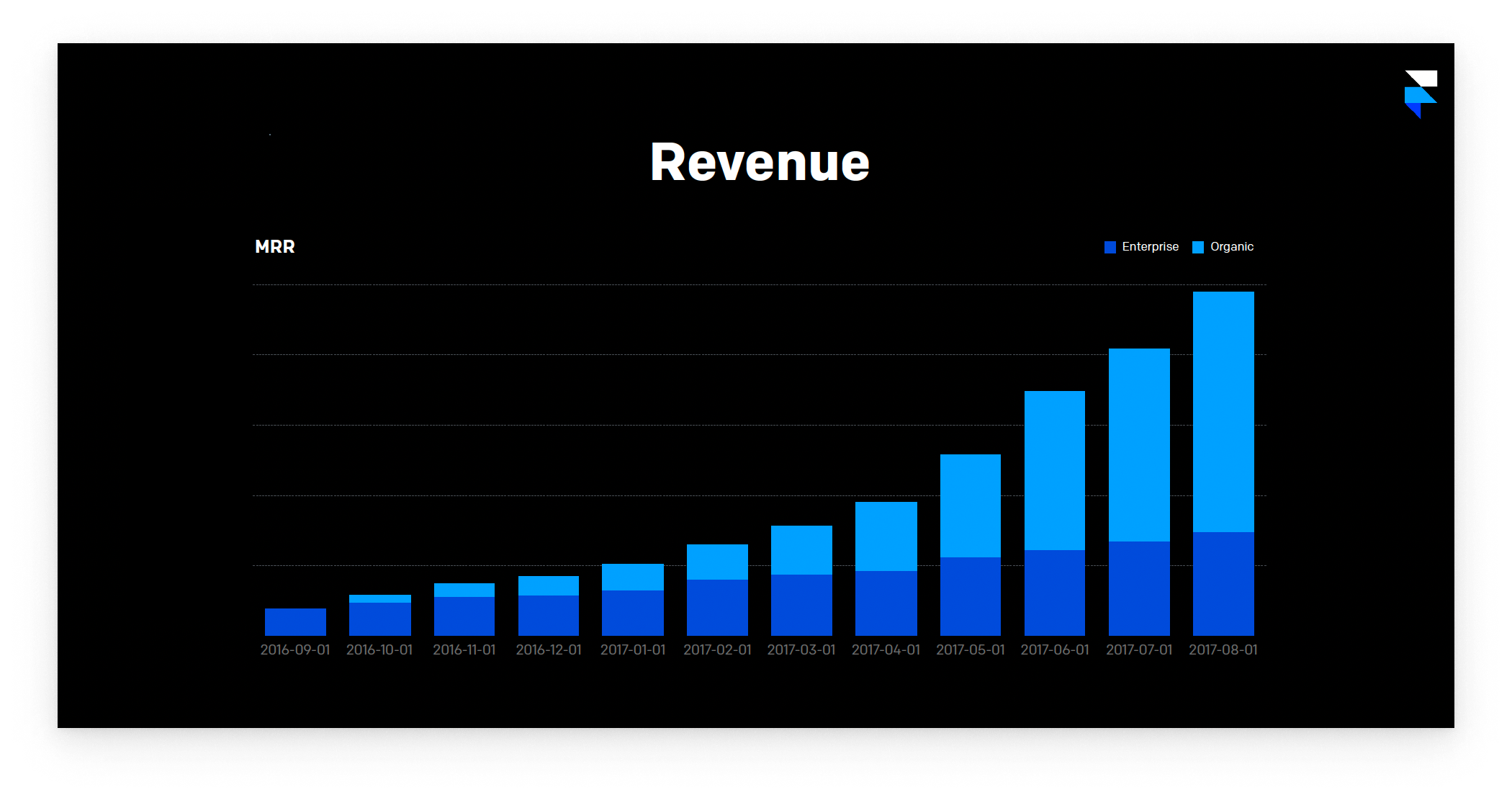

Another example where the generic headline hides how amazing this data is. The title “Revenue” doesn’t mean much, but “1000% Revenue Growth in One Year” does!

6. Always anticipate the questions

Last but not least, anticipate the questions. As you put your pitch deck together, it makes sense to remove certain things that you don't feel play to you strengths, but you should be ready to respond to the questions that will almost certainly come up.

For example, if you talk about your revenue growth but don’t have your burn or how much you’re spending to achieve that growth, you’d better be ready to get questions about that! Additionally, if you have a slide about the amount you want to raise but don’t have any info on why you want to raise that amount or what you’ll spend that money on, be ready to respond to questions about that, too.

A great way to be ready for these kinds of questions is to add a slide with that information to the appendix, so you can jump to that if/when the question comes up without interrupting your narrative flow.

Ship and iterate

The good news and the bad news: there’s no one magic bullet for creating a great pitch deck. The best deck for your company will change as your company grows, your stage shifts, and you talk to new investors. Don’t get married to the first draft you like—remember that a pitch deck is a tool that needs to be methodically updated. Like building good products, don’t be afraid to ship and iterate as you fundraise.

Here’s a quick summary of what to keep in mind as you develop your next pitch deck:

- First and foremost, focus on how your company will enable investors to 50x-100x their money

- Always tailor your story to the investor and the stage

- Center your story around your company’s 2-3 core strengths

- Explain why the problem you’re solving is a hair-on-fire problem

- Keep your narrative focused and memorable

- Anticipate investor questions and prepare responses

For even more advice from leading investors and recommended resources, access our Pitch Deck Resource Library—built as an extension of this guide to support you in your fundraising journey.